Swissquote became established as Switzerland’s first ‘entirely online’ bank, taking the ‘Best Swiss Online Broker’ award in 2001. It has since become one of the nation’s top-rated forex brokers, providing its clients with high leverage trading in a wide array of financial instruments.

While the platform is undoubtedly geared towards the trading of currency pairs, it offers an impressive arsenal of cryptocurrencies, stock indices, forex options, precious metals, and even bonds that can be bought, held and sold on the platform.

Another element that sets this broker apart from its competition is the FIX API software that allows private traders and institutions to access its deep liquidity pool and real-time quotes with an initial deposit of $50,000. Private traders who decide to go down this route will also enjoy custom spreads, along with the commission-free trades enjoyed by its regular customers.

Regular traders can choose between Standard, Premium and Prime accounts, which offer spreads ranging from 1.7 pips to 1.1 pips, and a minimum balance of between $1,000 and $50,000.

Aside from the higher-than-average minimum deposit amount, another downside is that Swissquote is not regulated in either the US or Canada, meaning that North Americans will not be able to open an account with the broker. This also applies to anyone who is living in Europe but is an American or Canadian resident for tax purposes.

This Swissquote broker review will explore why this company is so highly rated in the forex world.

Broker Intro

The Swissquote story began in 1996, when Mark Bürki and Paolo Buzzi created a company called Marvel Communications SA that specialised in producing and selling financial software and web applications. That year, the company launched what would be the first iteration of Swissquote, as one of the first platforms to offer customers free access to real-time quotes on all securities traded on the Swiss Stock Exchange.

In 2001, Swissquote obtained a banking licence that would allow it to gain access to some of the top US exchanges, including the NYSE, NASDAQ and AMEX. Shortly after this, Swissquote became the first fully online bank in Switzerland.

In 2010, it acquired one of Switzerland’s largest currency trading platforms, Advanced Currency Markets AG (ACM), a move that helped to rapidly expand its forex services. Three years later, Swissquote would complete another acquisition, this time taking on another major forex broker, MIG Bank, making it one of Switzerland’s largest forex providers at that time. This move prompted Swissquote to incorporate in London, allowing it to offer forex services to all markets in the EU.

2017 saw another important milestone as the company began to provide its customers with access to five large-cap cryptocurrencies: Bitcoin, Ethereum, Bitcoin Cash, Litecoin and Ripple.

In 2019, Swissquote acquired Luxembourg-based Internaxx Bank SA, bringing it unrestricted access to European markets. In the same year, it opened a branch in the Asia-Pacific region, expanding its clients’ access to an ever-more comprehensive array of markets.

Today, Swissquote has over 390,000 clients worldwide and over CHF33.5bn in client assets, offering over 3m different financial instruments and products for trading.

Spreads & Leverage

Overall, you will find that Swissquote offers competitive spreads, which change depending on the type of account you choose. Spreads range from 1.7 pips on the most basic (Standard) account to as low as 1.1 pips on the Prime account. The highest-tier option, called the Professional account, offers a custom pip option.

The Standard, Premium and Prime accounts come with the same 1:1000 leverage options. Premium accounts are the most popular choice for trading forex and CFDs. However, the Professional account allows traders to receive custom leverage depending on the amount of volume they trade.

Platform & Tools

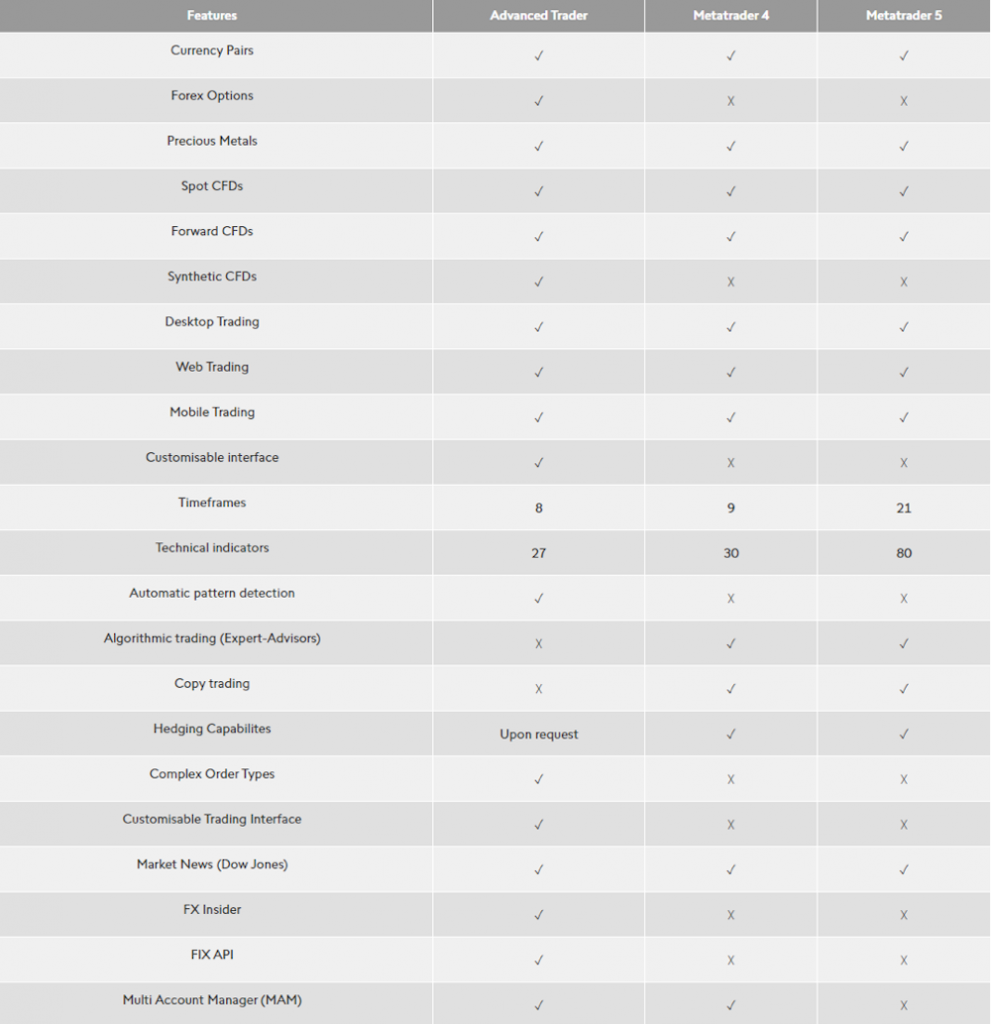

One of the more impressive aspects of Swissquote is the number of platform options that it makes available to its traders, including the ever popular MetaTrader 4 and 5. However, you will not be able to use either MetaTrader platform to trade forex options, which you may find disappointing.

As of now, the three available options include the following:

Advanced Trader: Advanced Trader is Swissquote’s own web platform, which has been designed for forex and CFD trading. Advanced Trader incorporates the user-friendly TradingView interface and gives traders access to over 80 technical indicators and 50 unique charting tools. The trading interface is highly customisable – you will be able to customise almost every component of the platform, including personalised technical indicators.

Advanced Trader will also allow you to run many different charts simultaneously. These can be accessed via both the desktop and mobile versions of the software. Unlike some other popular charting interfaces, Advanced Trader can be accessed through the web browser, without the need for you to download and install third-party software.

As well as the standard order types, Advanced Trader provides traders with three additional order types that you will not always find available through other trading interfaces:

- Order Cancels Other (OCO): A combination of a limit order and a stop order. When one is executed, the other is automatically cancelled. For example, say a trader purchased a currency pair valued at $1.27 and expected the pair to trade higher in the future. Instead of setting both a stop loss and limit order, they can set an OCO order for $1.23 and $1.36. In this case, if the pair fell to $1.23, it would execute a sell, and it would also cancel the sell order at $1.36. Conversely, if the opposite were true, and the price hit $1.36, it would sell the position and cancel the stop loss order of $1.23.

- IF-DONE order: Also known as a Slave order, an IF-DONE order is composed of a primary and a secondary action, whereby the secondary cannot be executed unless the first one is completed. For example, a trader may set a stop loss order, but only if a buy order is executed first.

- If-OCO: A variant of the IF-DONE order in which an OCO order is placed only when a predefined condition (the if statement) is met. For example, an If-OCO order may read something like: “If the price increases by 5%, place an If-Done order, set a buy order and a stop loss order at a given price.”

Although not everyone will require these types of orders, they can be very useful for advanced traders, especially those running complex trading algorithms or automated trading bots.

MetaTrader 4 (MT4): Considered by many as the gold standard of trading platforms, MT4 is by far the most popular and well-used forex trading interface on the market. Aside from the 23 analytical tools and 30 technical indicators, MT4 offers you the option to create customisable indicators, along with a robust backtesting framework in which to test them. MT4 also supports various social or copy trading capabilities and highly customisable charts. Unfortunately, as mentioned earlier, if you are looking to trade forex options on Swissquote, you will not be able to do so with MT4. However, currency pairs, precious metals, and CFDs are available to trade on this platform.

MetaTrader 5 (MT5): The newest version of the MetaTrader family of trading software, MT5 offers all the high-level functionality of MT4, with a few additional benefits. Instead of 30 technical indicators, MT5 supports a total of 80 indicators and more than double the amount of available timeframes. As with MT4, you will not be able to use MT5 to trade forex options, but you can still trade currency pairs, precious metals, and CFDs where legal to do so.

Swissquote also provides access to a service called the ‘Financial Information eXchange protocol’ (FIX API). This API can be plugged into almost any trading platform and will give you access to real-time and historical market data, as well as the broker’s deep liquidity pool. It also allows you to execute fast and secure trades over the Swissquote trading network.

The most common FIX API software users are institutional partners, brokers, corporations, hedge funds and asset managers, and private traders. Regardless of who the user is, Swissquote requires a minimum deposit of $50,000 to use the FIX API software.

Commissions & Fees

- Commission-free trades are offered on all account types except for the Professional account, which has bespoke pricing.

- If an account goes through an inactivity period of six months, the account holder is charged 10 units of their account’s base currency.

- Maximum quarterly custodian fees of CHF50 are applicable (roughly equivalent to €44.99, £38.62 and $53.77 at the time of writing).

- Options and futures trading are available at CHF1.50.

- Flat-fee trades are available for high-volume trades.

- Active traders receive special discounts.

- Swissquote does not charge fees on any funding method, which includes credit cards and wire transfers.

- Swissquote offers a referral programme that can grant up to CHF800 if certain conditions are met.

Education

This Swissquote review has found that, as with most higher-level brokers, the platform offers an in-depth educational section that includes eBooks, seminars and webinars.

Along with the usual introductory trading materials offered by many brokers, the Swissquote eBooks section contains information on a range of other topics, including:

- How to trade with Japanese candlesticks

- Introduction to bond investing

- Swiss DOTS – An exclusive platform

- Themes Trading

- Cryptocurrencies: From Bitcoin to Ether

- Cryptocurrencies: Chainlink, Tezos and more

All eBooks are downloadable as PDFs and are available to customers and non-customers alike. In addition, the Advanced Trader and the two MetaTrader platforms have their own educational sections, covering many of the common introductory topics on trading and investing found on other platforms. You will also have access to daily financial news services in both trading environments, including both free and paid services.

Regular webinars are provided in many different languages. Those wishing to participate are required to sign up in advance, though space is not limited. While not all past webinars are accessible, some are provided on demand, and cover useful topics including helpful guides to using robo advisory investment strategies and risk management in forex trading.

You can also join seminars on the Swissquote platform. These are live, in-person events where expert traders and speakers give talks and lectures on a variety of trading-related topics and strategies. These seminars are hosted in many different locations all around the world. Unfortunately, however, these have been temporarily suspended due to the COVID-19 pandemic and replaced by some online tutorial videos.

You can also visit Swissquote’s online Newsroom for daily news briefs on issues that are likely to have an impact on the financial world. The articles listed are not limited to solely forex-related topics, but also cover issues that affect stock, indices, bonds and all other financial instruments.

Customer Service

In our review Swissquote was found to offer an informative FAQ section, as well as live customer telephone support from Monday to Friday, 8:00-22:00 CET. You can also raise a support request via the online contact form.

If you experience issues with the robo advisory service, you can set up a private phone or video chat meeting. Alternately, there is a dedicated email address and phone number that you can use.

The website also provides a live chat option, which is available to both current and prospective customers.

Broker Details

Parent company Swissquote Group Holding Ltd is headquartered in Gland, Switzerland, with offices in Zurich, Bern, London, Luxembourg, Malta, Dubai, Singapore and Hong Kong. At the time of writing this review, the company has 745 employees.

The group has three European trading arms:

- Swissquote Bank Ltd is based in Switzerland (Zurich) and is regulated by the Swiss Federal Financial Market Supervisory Authority (FINMA). It trades stocks, options, futures, cryptocurrencies and currency pairs.

- Swissquote Ltd is based in the UK (London) and is regulated by the Financial Conduct Authority (FCA). Swissquote Ltd trades in CFDs, forex and cryptocurrencies.

- Swissquote Financial Services (Malta) Ltd is based in Valletta and is regulated by the Malta Financial Services Authority (MFSA) to manage various fund activities, traditional and alternative investments, precious metals and commodities.

Swissquote Bank Ltd is backed by deposit insurance, meaning that all individuals holding accounts with Swissquote will receive either full or partial coverage in the event of bankruptcy.

Swissquote Group Holding Ltd is currently listed on the SIX Swiss Exchange under the symbol SQN.

This broker offers trading in over 80 currency crosses, including the most popular major, minor and emerging pairs, all with a 1% margin requirement.

Aside from forex pairs, you also have the option to trade forex options, precious metals, global stock indices, over 20 popular commodities and bonds.

CFDs are available, providing exposure to currencies, metals, stock indices, commodities and bonds. Our Swissquote CFD review finds this broker to provide competitive trading conditions, with transparent pricing and zero commissions on trades.

Our Swissquote cryptocurrency review notes that the broker offers 12 different cryptocurrencies paired in USD. The currently supported coins and tokens include Bitcoin, Bitcoin Cash, Ethereum, Chainlink, Ethereum Classic, EOS, Stellar, Tezos, Auger, Litecoin, Ripple, and 0x.

Robo-Advisor is an automated investment manager that creates and monitors an investment portfolio specially tailored to the user’s risk appetite. To learn more about this service, you can download and read the white paper.

Contacts

Swissquote can be contacted by email, live chat, phone and fax. For a complete overview of the group’s worldwide offices and contact details, visit the Swissquote Group page.

Final Thoughts

Our Swissquote forex review believes that this broker provides an attractive option for traders looking for a thin-spread, commission-free broker that offers professional-grade trading platforms at no extra cost. Clients using the Advanced Traders trading environment will be able to buy and sell forex options, a service that is not available with every broker.

The platform’s proprietary robo advisory software is quite unique in the field of forex trading, and you are unlikely to find a similar service elsewhere. Swissquote also allows users to trade a much higher number of cryptocurrency pairs than the majority of its competitors, and has provided its clients with access to a handful of coins and tokens that many experts believe will become significant players in the cryptocurrency space, namely Chainlink and 0x.

All in all, Swissquote offers a robust trading platform with a high number of currency options, including all the most popular major and minor pairs. This variety, together with quality customer service, deposit protection and no deposit fees, makes Swissquote an excellent option for traders in Switzerland, Malta and the UK.